As previously announced, BigPay is now offering digital personal loans with the aim of empowering the unbanked community. BigPay is a Capital A-invested digital finance platform that started as an e-wallet with a physical prepaid card. Currently, they have 1.2 million transaction card users and they have seen 2x year-over-year growth in 2021. According to Capital A CEO Tony Fernandes, 55 % of Malaysians are underbanked.

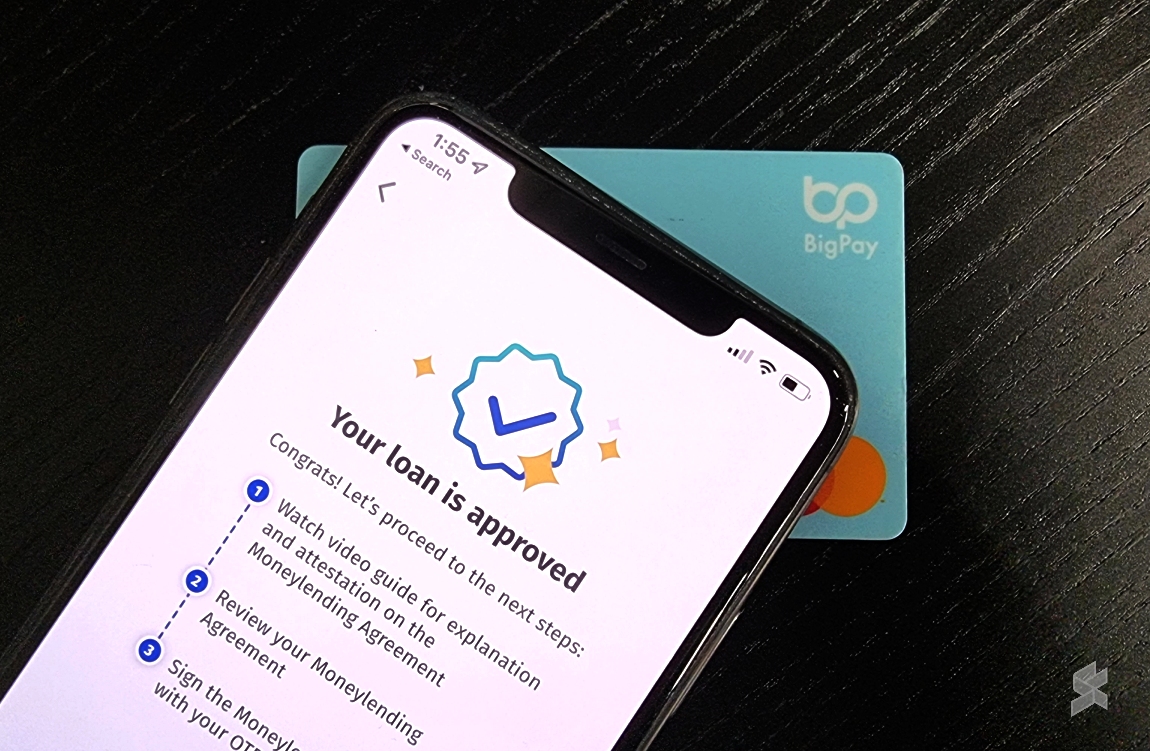

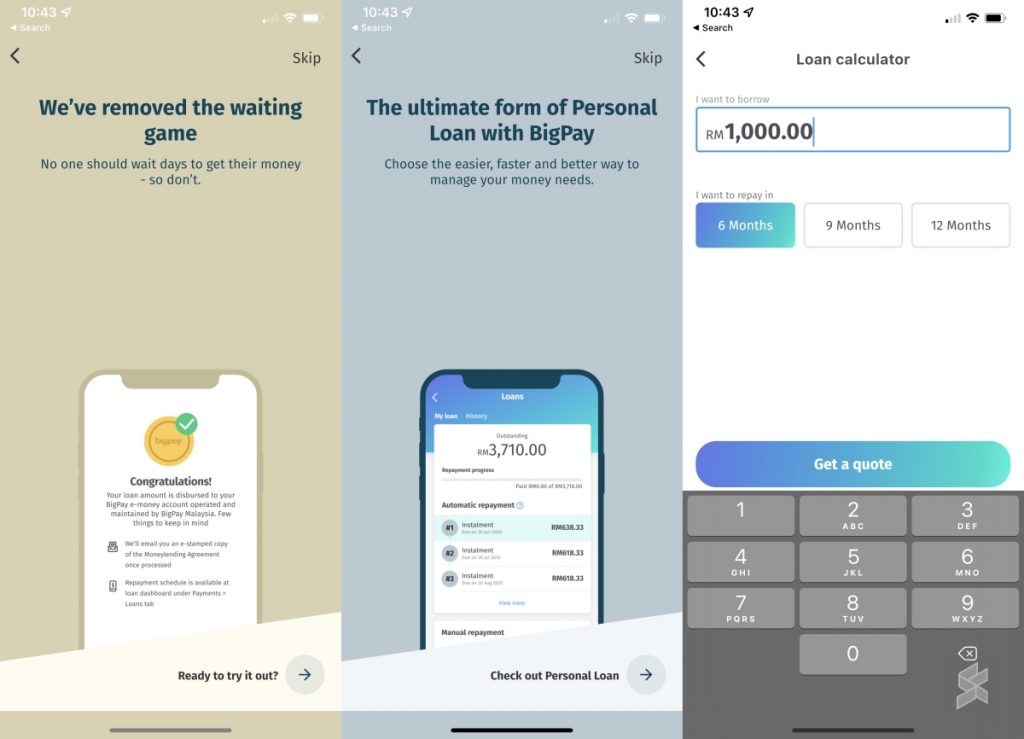

Based on our first product preview, the personal loan option will appear as a new feature in the BigPay app under the "Payments" section. According to the introduction, the personal loan product offers approvals as fast as 5 minutes. As this is a completely digital service, no paperwork is required and you can apply and issue refunds within the app itself.

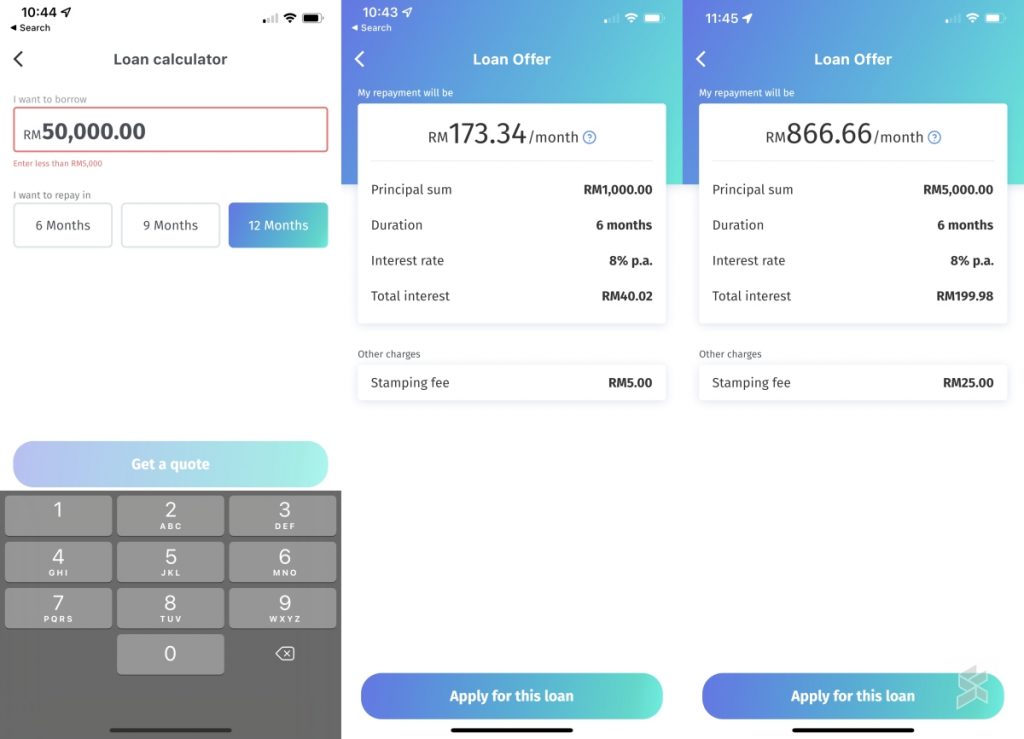

From our experience, BigPay offers loans between RM1,000 and RM5,000 with an interest rate of 8% per annum. According to BigPay CEO Salim Dhanani, the interest rate is based on risk-based pricing, so a long-term BigPay user might get a more favorable rate. In terms of duration, BigPay offers a payout period of 6, 9 or 12 months. There is a stamping fee of 0.05%, so if you apply for a loan of RM5,000, it will cost you RM25 for the stamping fee.

For a loan of RM1,000 for 6 months, repayment would be calculated at RM173.34/month. Meanwhile, a loan of RM5,000 for 6 months will be calculated at RM866.66/month.

As you would expect from BigPay, the interface is clean and simple. When applying for a loan, the app will display the monthly repayment, total interest, and other charges for clarity. If you accept the conditions, you can continue by providing your personal data and answering a few questions.

The whole application process is quite transparent and straightforward. It doesn't even require you to submit a copy of your payslip, bank statement, or EPF statement. If you meet their criteria, your loan should be approved in as fast as 5 minutes. However, if additional verification is required, verification may take up to one business day.

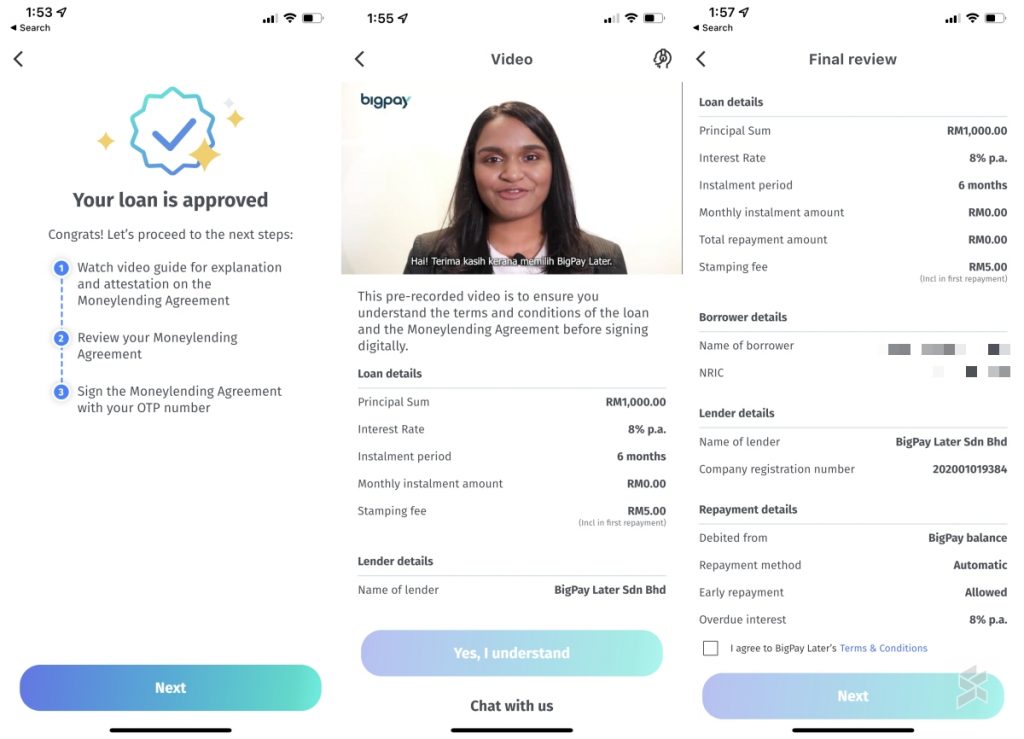

Once the loan is approved, you have the opportunity to review your loan offer and you will need to watch a video to understand the terms and conditions. If you have any questions, it also provides a shortcut to chat with customer service.

To accept the loan, you will need to verify through OTP and this will be accepted as the signing of the loan agreement. Refunds are made through the BigPay balance app itself, which currently accepts top-ups via online banking, credit or debit cards, or cash at 7-Eleven. Loan disbursement is done directly to your BigPay account, so you can use it for immediate spending via your BigPay card or withdraw cash from an ATM.

The money lending agreement for the unsecured loan is issued by BigPay Later Sdn Bhd. It is a licensed lender under the Lenders Act 1951 by the Department of Housing and Local Government (KPKT). The loan is currently not Sharia compliant, but this is something BigPay is working on.

For customers who do not repay the loan principal or interest, BigPay is entitled to charge additional default interest on the outstanding amount up to 8% per annum. If you do not pay a deposit beyond 28 days after the due date, BigPay may terminate the contract and take legal action.

Overall, it's a quick and easy way to get a loan on demand, which is useful when you need money for repairs or medical emergencies. This is also useful for the underbanked community, especially for consumers who do not have access to a credit card. At the moment, the Personal Loans feature is not yet available to everyone and it will be gradually rolled out to the public over the next six months.