California payday loans can lend up to $300 and levy a maximum of $45 in fees. While this charge may not appear excessive, the average annual percentage rate for payday loans is 372 percent. This is far higher than the interest rate on most other loans or credit cards.

Payday lenders frequently do not evaluate whether you will be able to repay the loan since they may simply cash your check or access your bank account. This means you may not have enough money to cover other costs, requiring you to take out another loan.

#1 California Payday Loan in 2021 - Viva Payday Loans

Best California Payday Loans - Quick-Pick

What Are California Payday Loans?

Payday loans are a sort of alternative financial service that provides quick cash to meet unexpected needs or assist borrowers in paying their bills from one paycheck to the next. These sources of finance have a short payback time and are aptly referred to as "payday loans" since the loan's duration generally corresponds to the borrower's payday timeline. A balloon payment is usually payable on the borrower's following payday after the loan is issued.

The loans are usually for $500 or less and are payable two to four weeks after they are made. Loan terms vary depending on the borrower's pay schedule or how frequently money is received-for example, the loan might be for one week, two weeks, or one month. Lenders who pay more often throughout a month can take out much more loans in a particular time than those who pay monthly.

Online payday loans are arranged the same way as traditional storefront loans, except that all communication occurs online. This comprises the loan application, authorisation for a lender to withdraw funds from the borrower's checking account electronically, and direct deposit of borrowed funds into the borrower's checking account.

Common Uses of California Payday Loans?

So why should you take California payday loans? Below are some of the common uses of California payday loans, according to most borrowers:

1. Consolidate Your Debt To Pay Off Your Payments

One of the most common reasons for taking out a payday loan is to consolidate debt. If you can get a cheap interest rate, this strategy may make sense. If you use the money from a payday loan to pay off your other obligations, you'll just have one set monthly payment, and you might be able to save money on interest.

2. Pay For Funeral Expenses

The surviving family members may face severe financial hardship whenever anyone dies without leaving adequate cash for funeral expenses.

In 2019, the average cost of a funeral, including viewing and burial, was $7,640, according to the National Funeral Directors Association. Many people will not have enough money saved to meet that amount all at once.

If you cannot afford the costs of a funeral, a memorial service loan may be an option. Even if you have terrible credit, you may be able to obtain a funeral loan.

3. Make A Significant Purchase

You can use a Payday loan to fund a significant purchase, but you shouldn't borrow money to buy a new entertainment system, patio set, or automobile. Some significant expenditures are unavoidable, such as the unexpected requirement for a new major appliance.

While you can use a personal loan to purchase a car, auto loans are frequently preferred since they offer lower rates and simple qualification criteria.

How To Qualify For California Payday Loans? (Eligibility Criteria)

To apply for California payday loans poor credit online using any of the previously listed platforms, you must satisfy the following criteria:

- Be at least 18 years old

- A valid identification card is required.

- You must show proof of earning at least $1,000 per month, as well as supporting papers such as pay stubs, bank statements, and proof of residency.

- You must be a US citizen or a registered permanent resident of the United States.

- You must have an active account with a recognized bank in the United States.

- You must have an open bank account.

Best California Payday Loans - Fully Reviewed

If you have made up your mind to apply for California payday loans, find our 5 best California payday loans comprehensive review below:

1. Viva Payday Loans - Overall Best Payday Loan Option in California

Viva Payday Loans will help you solve all of your financial problems fast by providing no-guarantor loans in just a few minutes. The best lenders examine clients' applications and provide them with the loan amount they want.

Viva Payday Loans connects you with various lenders that offer you a loan after your application is approved. Viva Payday Loans can connect you to top lenders with flexible loan amounts, whether you need a few hundred dollars to deal with a sudden emergency or thousands of dollars for investment.

Even if you don't have perfect credit, the credit payday gateway will link you with reliable lenders, restricting your loan options elsewhere. Furthermore, Viva Payday Loans provides short-term credit loans to borrowers with high-interest debt due to their employment.

Please keep in mind that the interest rates at Viva Payday Loans vary from one lender to the next. However, they often range from 5.99 percent to 35.99 percent. Viva Payday Loans also provides loans to those with terrible credit, unemployed, and those who are on government assistance.

Pros- Loans are disbursed on the same day that they are approved.

- Flexible loan amounts of $200 to $5,000 are available.

- The process of application and approval is quick.

- Some states do not allow Viva Payday Loans.

2. Money Lender Squad - Best For No Guarantors

The Money Lender Squad provides low-interest, non-guaranteed lending to the US market. For individuals with bad credit, the website offers payday loans with rapid approvals. Money Lender Squad may give a no-credit-check personal loan for up to two years or a short-term cash loan for up to two months.

Clients apply for a loan by completing an online application form with personal information and attaching supporting paperwork. There is no serious credit check because the Money Lender Squad is mainly concerned with affordability.

Money Lender Squad's application for bad credit payday loans takes only a few minutes. Borrowers just need to enter their personal information into an online form and click "Submit." Subsequently, the application form is submitted to lenders who are most likely to approve it using an automated method.

If your request is granted, you will be contacted by one of the Money Lender Squad's lenders, and you will be sent to their website to complete the process. The lenders will then be able to assess whether or not you can accommodate your application. Fortunately, the entire procedure takes only a few minutes.

- Long-term loans are available.

- The online application process is quick and straightforward.

- To apply, users do not require a guarantor.

- If you have a poor credit score, your interest rate will be higher.

3. Credit Clock - Best for Fast Approvals

Credit Clock is the most suitable alternative for you. These dealers offer payday loans, personal loans, bad credit payday loans, and emergency loans to customers deemed qualified based on their applications due to quick payments, simple loan approval procedure, and acceptance of even low credit.

When a client is in a rush, the credit clock comes in helpful since its quick loan approval method saves time, and more payout takes a short time. To continue with the loan application, you must meet the credit clock's minimum income standards.

Anyone over the age of 18 who is a recognized and legal resident of the United States can use this site to get financial help from certified lenders that accept customers with bad credit. You may be asked to produce proof of domicile and income during the procedure if the lender demands it.

- The procedure of approval is quick.

- Within 24 hours, funds are released.

- Individuals with bad credit are allowed to apply.

- Permanent residents of the United States who are 18 years old or older are eligible.

- You may need your information due.

- Because there is a $1,000 minimum earnings criterion, qualifying is based on affordability.

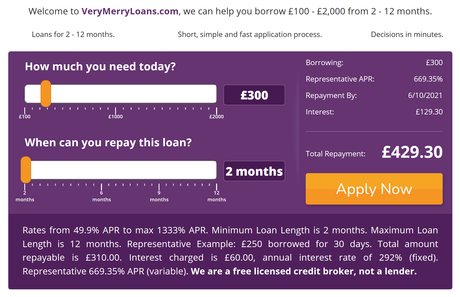

4. Very Merry Loans - Best for Same Day Payouts

Cons

The internet platform of Very Merry Loans links qualified borrowers with competent lenders across the United States. Even people with bad credit may get quick access to Very Merry payday loans. You can receive your payment in as little as a few minutes after submitting your application successfully-the loans are usually repaid in less than 24 hours.

People may apply for a payday loan that matches their financial situation on the site, with loan amounts ranging from $200 to $5000. Applicants must be at least 18 years old, citizens of the United States, and earn at least $1000 a month. Some lenders may need proof of your identification or residence. Very Merry Loans is known for its simple lending method, which combines a panel of verified and popular lenders with loan applications from clients to pay out loan requests quickly and legally.

Clients repay their payday loans, which are usually for 7 to 31 days. However, longer loan terms are available, allowing them to pay off their obligations in as little as 24 months. To avoid any difficulty, you must comprehend all of the terms and restrictions associated with taking out a payday loan from any money lending app.

- Lenders accept unemployed and low-credit candidates.

- The annual percentage rate (APR) varies from 5.99 to 35.99 percent.

- Longer-term loans are also available.

- Citizens of the United States are required to apply.

- Clients must return high-interest loans within 30 days of receiving them.

5. Heart Paydays - Best for No Guarantors Required

Cons

Heart Payday is another well-known loan service in the populous United States. By providing appropriate online services loans, the website reduces the cumbersome aspect of retail loan applications. In addition, all candidates for this sort of payday loan must finish the entire online application procedure in under five minutes.

Heart Paydays completes the loan payout in one hour or less (at most one day). Furthermore, this payday loan is well-known for providing loans to those turned down by other lending companies.

Fortunately, you may obtain a loan via Heart Paydays even if you have bad credit, are unemployed, receive government assistance, or just need a cash boost until your next paycheck payday.

Heart Paydays is well known for its low-interest rates, especially on short-term loans. The bulk of lenders offering loans through the platform retain affordable rates, with maximum APRs reaching 35.99%.

- No paperwork or phone calls are required for applications.

- Your payments will be available to you within one hour after approval or within 24 hours if there is a chance of a delay.

- Some loan offers may include exorbitant fees.

Features of California Payday Loans

Pros- Simple application: To apply for the loan, you simply need to download the app or log in to the company's website, fill out a form, and upload the specified documents to prove your identity and income (as previously mentioned)

- Quick, paperless, and no-show approval and disbursement: If you've got everything required, the loan will be approved, and funds will be deposited into your desired bank account in less than 60 minutes. The processes of credit score checking and completing your KYC process are done electronically, making the background verification completed almost instantly.

- Flexible loan amounts: Depending on your monthly salary, repayment ability, and the terms and conditions of your prefered product, you can easily borrow between Rs.1,500 and Rs.1 lakh.

- Micropurpose: like most personal loans, you can use the microloans for anything- paying your credit card bill before the due date, paying school fees, funding a medical emergency, wedding or travel, purchasing the latest smartphone or laptop - you name it.

Advantages of California Payday Loans

Cons1. Simple To Acquire

The most important benefit for many lenders is the ease with which you may obtain payday loans. Unlike more typical loan options, you may apply online in a matter of minutes, and you might send funds to your UK bank account the same day.

This is precisely what many individuals are searching for because these loans are frequently used to pay unforeseen expenditures such as vehicle repair bills or emergency house repairs.

Furthermore, borrowers have a wide range of options. Many lenders provide payday loan solutions, making this type of borrowing even more accessible.

2. Fewer Restrictions Than Other Types Of Loans

Many applicants are drawn to payday loans since the approval requirements are sometimes less stringent than other financing types. Clients with bad credit and low incomes are frequently authorized by payday lenders, although they do not fulfil the fundamental eligibility standards of banks and other organizations.

3. You Can Get Accepted Even If You Have Poor Credit

Like all other types of borrowing governed by the Consumer Credit Act, payday loans have a 14-day cooling-off period. This implies that you have the right to rescind the contract within 14 days if you think otherwise.

You must return the loan and any interest that has accumulated if you cancel your payday loan. Moreover, the lender must reimburse you for any charges or fees that you paid.

4. A 14-Day Cooling-Off Period Is Available

Like all kinds of borrowing endorsed by the Consumer Credit Act of 1974, Payday loans have a 14-day cooling-off period. This implies that if you change your decision, you have 14 days to terminate the agreement.

However, keep in mind that upon cancelling the payday loan, you'll have to repay the full amount plus the accrued interest, but you'll be reimbursed for any fees or charges that you incurred.

5. Quick Cash For Unforeseen Bills

During emergencies, you may not have all the time to wait for the long-winded approval processes in most traditional borrowing institutions. Say if your car, which your business depends on, breaks down and you don't have the cash to fix it. In this case, you can't afford to wait for long as this will significantly affect your business.

In addition to providing online forms to save you from the hassles associated with visiting a physical store, many lenders can transfer funds to your account within minutes after approving your application.

For example, Lending Stream is reputable for disbursing funds in the applicant's bank account within 90 seconds after approving the loan request. However, this may vary in different cases depending on the applicant's bank policies-others may take longer.

6. Reliable Authorized And Regulated Lenders

Initially, you did not regulate the payday industry closely. However, the Financial Conduct Authority has been keeping a close eye on the payday lending industry in the recent past.

Before engaging in any restricted activity, such as offering loans or loan broker activities, lenders must register with the Financial Conduct Authority.

After being approved, the companies are listed on the Financial Service Register.

Individuals seeking quick loans can profit from the protection provided by the Financial Conduct Authority.

Before applying for the loans, borrowers are advised to check the Financial Services Register to ensure that they are dealing with an authorized and regulated firm.

Disadvantages of California Payday Loans

1. They're Costly

Payday loans might be prohibitively costly at times. Some lenders charge interest rates of up to 1,500 percent APR, which can lead the cost of borrowing to spiral out of control. Fortunately, many alternative types of borrowing have lower interest rates-so it's simple to notice how some individuals struggle to repay payday lenders when the fees are so high.

2. Payday Loans Target the Minority

Payday loans are viewed as predatory by some since they target those with low incomes and poor credit. While many other lenders and financial organizations do this, payday lenders have a terrible reputation for aggressively chasing unpaid loans in the past. Although the industry is more regulated than ever before, it is still vital to research your alternatives before applying for a loan.

3. It is Easy to Get Stuck In A Debt Cycle

Payday loans, which typically carry extremely high-interest rates, may put consumers in greater danger of getting into debt. Whenever you fail to pay back your payday loan on time, you may find yourself in a financial trap. As a result, you may need to borrow other loans from other lenders to settle your previous debt, leading to a terrible scenario.

4. They Have Unauthorized Access To Your Bank Account

Payday lenders frequently advise that payments be made through Continuing Payment Authority (CPA). This allows them to collect regular payments straight from your account. While you may revoke their authorization at any moment, some people consider this to be a terrible action to make.

How To Get California Payday Loans

Although each loan website operates independently, they are all linked in the application process. Most of their websites feature an easy-to-use structure, permitting you to request a loan with no difficulty.

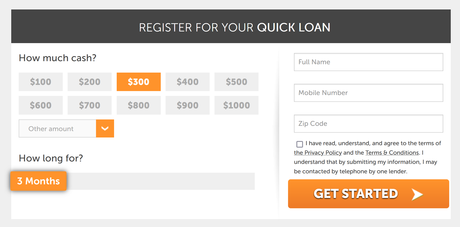

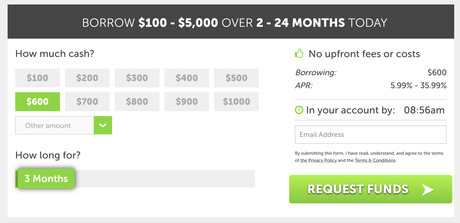

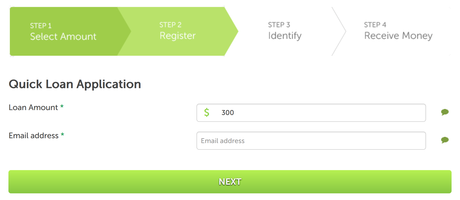

Below is an example of the Viva Payday Loan application process.

Step 1: Visit Viva Payday Loans

To obtain a basic layout, go to Vivapaydayloans.com and click the "Apply Now" option at the top right of the site.

Step 2: Complete The Application Form

You will be given an application form in which you must provide your official name and personal data, as well as your earnings and bank details.

Step 3: Get Your Decision

The approval process will take two minutes, so don't leave the website before getting feedback. Besides, they'll also inform you if your application has been rejected.

Step 4: Receive Your Loan

Once your request is approved, you will receive an agreement form through your email so that you review and sign. You must comprehend the terms offered. When you submit a completed agreement form, the procedure of depositing cash into your bank account will begin promptly.

Step 5: What if I'm Not Approved?

If your application is denied, you are free to look into alternative loan choices, such as the Credit Clock or Heart Payday, among others.

You shouldn't be concerned about your credit record because these services never perform a thorough credit report and are completely free.

Conclusion

Califonia payday loans can come in handy, especially when you have an emergency or facing a financial urgency you need to address. At Viva Payday Loans , you can apply for California payday loans and get approved in minutes.

Request Your Payday Loan at our Top Rated Provider - Viva Payday Loans