Renowned investor Cathie Wood says the ARK Innovation ETF ( ARKK) - Get the ARK Innovation ETF Report is expected to return a whopping 50% annually through 2026 as growth and technology lag behind for a rebound.

Meanwhile, skeptics argued that ARKK's share price weakness was nothing more than a correction from years of irrational exuberance that lasted into early 2021. he current environment of high inflation and rising interest rates should dampen aggressive growth investing.

It doesn't matter which side of the argument you subscribe to. In my opinion, the best strategy for trading ARKK is largely independent of these fundamental questions. Instead, I think entries and exits in this case should be informed primarily by price action.

The recent sell-off that followed a "dead cat bounce" in late March in ARK Innovation has only bolstered this idea, which I'll discuss in more detail below.

(Learn more about Wall Street memes: Tilray Stock: 3 catalysts we expect)How to trade ARKK

I started talking about how I think ARKK should be traded in January 2022.

First, it helps if one has the belief that over a long period of time (many years, in fact), growth stocks will eventually find their way north. I think that's a reasonable assumption, if I'm able to look past the immediate headwinds: rising consumer prices and yields, risk of an economic downturn, geopolitical instability, etc.

Next, note that ARKK has been trading like a bubble since 2017. The ETF soared over 500% in the five years ending in December 2020. Then, from the February 2021 peak, the fund has lost two-thirds of its value. in just over 12 months.

This is classic bubble behavior that reminds me of the Japanese stock market in the 1980s and the tech-heavy Nasdaq index in the 1990s, during the dot-com mania.

Bubbles are a gift for those who know how to play them. In a recent interview, famed fund manager Stan Druckenmiller championed the idea of trading bullish bubbles even if the fundamentals aren't supporting prices - provided investors pull out before the burst.

This is precisely what is behind my idea of owning ARKK, the classic bubble of the 2020s, only when the ETF is trading above its 50-day moving average. When the stock price falls below, investors need to walk away to avoid being caught in a downward spiral.

By doing so, an investor can be bullish and avoid bearish breakouts. The approach doesn't work as well for "common stocks" or ETFs, but generally does in cases where "the herd" is pushing prices sharply up and down like a wave.

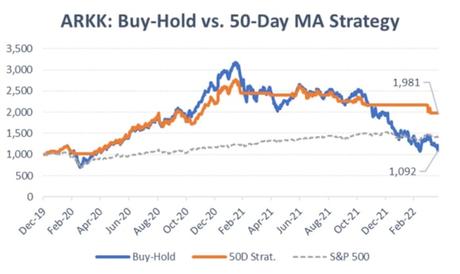

Below is a chart that shows how ARKK investors would have performed since the start of 2020 had they (1) simply bought and held the fund versus (2) followed a 50-day moving average strategy, as I suggested.

DM Martins Research, data from Yahoo Finance

Notice above how trading ARKK's 50-day moving average over the last 30 or so months would have resulted in cumulative gains of almost 100% - much better than the buy and hold strategy which would have been virtually stable, and even the S&P 500. 40% return.

But was I not mistaken at the end of March?

Those who follow me must have noticed something that could damage the credibility of my strategy. As late as March 30, and using the same moving average guidelines, I declared that it was time to own ARKK again.

The ETF was trading at $71 per share at the time. Over the next three and a half weeks, the fund lost 26% of its market value. Didn't I time this entry terribly?

Yes and no. While the moving average approach would have triggered a buy on March 30, it would also have triggered a sell on April 5. Therefore, the timed strategy would have produced monthly losses of only 2% against a decline of 20% for the buy and hold approach.

Recent price action teaches an important lesson in being diligent in following the trading process. Going forward, I believe the strategy will continue to work well for ARKK traders who adopt it.

(Disclaimer: This is not investment advice. The author may own one or more stocks mentioned in this report. Additionally, the article may contain affiliate links. These partnerships do not influence editorial content. Thanks for supporting Wall Street Memes)