The dollar is recovering slightly in calm trading in Asia, digesting some of the losses from the past week. The yen and Canadian dollar trail the greenback, while the Swiss franc leads the Europeans lower. But overall, major pairs and crossovers are limited inside Friday's range, suggesting a lack of activity. The economic calendar is light today and trade could remain subdued. But there are plenty of important economic data forecast for the week, including inflation, retail sales and employment, which deserve attention.

EUR/GBP is a pair to watch this week as the UK government will finally announce a new fiscal plan on Thursday. In addition, the UK will release a batch of economic data. Technically, the 0.9267 corrective shape could be considered finalized with three waves down to 0.8570. The break of the resistance at 0.8827 will confirm this case. A further break of 0.8869 will open a stronger rebound towards 0.9267 high. Still, the break of 0.8689 support will likely extend the correction to 0.8570.

In Asia, at the time of writing, the Nikkei is down -0.78%. Hong Kong's HSI is up 2.63%. China Shanghai SSE is up 0.47%. Singapore Strait Times is up 1.51%. Japan's 10-year JGB yield is up from 0.146 to 0.246.

BoJ Kuroda: should continue monetary easingBoJ Governor Haruhiko Kuroda said in a speech that Japan's situation "differs" from both the United States and the eurozone. The country is still "in the process of recovery". The output gap has "stayed in negative territory" but is expected to "turn positive" at some point in the second half of this fiscal year. The inflation rate "has not increased on the demand side". The current rise in inflation has been "led by rising import prices", and the rate is expected to return to below 2% from fiscal 2023.

He reiterated that the BoJ "believes that it must pursue monetary easing and thus firmly support economic activity". In doing so, "it aims to provide a favorable environment for businesses to increase wages and achieve the objective of price stability in a sustainable and stable manner, accompanied by wage increases".

Regarding exchange rates, Kuroda said that "the sharp and abnormally unilateral weakening of the yen appears to have come to a halt, partly thanks to government intervention in foreign exchange." He stressed that it is "important that exchange rates move in a stable manner, reflecting economic fundamentals".

Fed Waller: Start paying attention to the endpoint, not the paceFed Governor Christopher Waller said over the weekend, "we're at a point where we can start thinking maybe at a slower pace," but "we're not softening."

"Stop paying attention to the rhythm and start paying attention to where the end point will be," he urged. "Until we reduce inflation, that end point is still a long way off."

Last week's CPI report was "good, finally, that we saw some evidence that inflation was starting to come down, but I just can't point out [enough] it is a data point. We're going to have to see a continued streak of this type of behavior and inflation slowly start to come down, before we really start thinking about taking our foot off the brakes here," he said.

Inflation, retail sales and employment data to watchMore inflation data will be presented this week, including the CPI from the UK, Canada and Japan, as well as the PPI from the US, UK and New Zealand. In addition, retail sales data from China, the United States and the United Kingdom will be presented. Employment data will be released in the UK and Australia. In addition, RBA will publish the minutes of the meetings.

Here are some highlights of the week:

- Monday: PPI Switzerland; Industrial production in the euro zone.

- Tuesday: Japan's GDP; RBA Minutes; China industrial production, retail sales, capital investment; UK employment data; Germany ZEW economic sentiment; Eurozone GDP, employment, trade balance; Manufacturing sales in Canada, wholesale; US PPI, Empire State manufacturing.

- Wednesday: Machinery orders in Japan, tertiary industry index; wage price index in Australia; UK CPI, PPI; Housing starts in Canada, CPI; US retail sales, industrial production, business inventories, NAHB housing index.

- Thursday: New Zealand IPP; Japan's trade balance; Employment in Australia; Swiss trade balance; Euro zone CPI final; US unemployment insurance claims, Philly Fed survey, building permits and housing starts.

- Friday: CPI Japan; UK Gfk consumer confidence, retail sales; Canada IPPI and IPMB; Sales of existing homes in the United States.

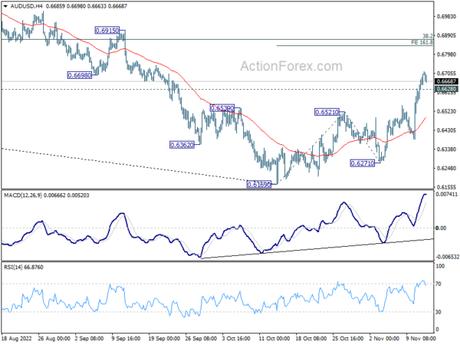

AUD/USD daily report

Daily pivots: (S1) 0.6618; (P) 0.6667; (R1) 0.6757; After...

AUD/USD is pulling back slightly today, but the intraday bias remains to the upside. The current rise of 0.6169 would target a 161.8% projection from 0.6169 to 0.6521 from 0.6271 to 0.6841. On the downside, minor support below 0.6628 will turn the intraday bias neutral and bring consolidations, before staging another rally.

Overall, the break of the support at 0.6680 turned into resistance confirming the medium term bottom at 0.6169. It is too early to call for a trend reversal. But even as a corrective move, the rise from 0.6169 should aim for a 38.2% retracement from 0.8006 to 0.6169 at 0.6871. A sustained trade above the 55 week EMA (now at 0.6934) will increase the chances of an uptrend starting. This week now remains the preferred case as long as 0.6521 resistance becomes support.