EURUSD trades at new intraday high

The EUR/USD is the currency pair comprising the single currency of the European Union, the euro (symbol €, code EUR), and the dollar of the United States (symbol $, code USD). The pair rate indicates how many euros are needed to buy a dollar. For example, when EUR/USD is trading at 1.2, it means that 1 euro equals 1.2 dollars. Why EUR/USD is the most popular trading pairCompared to all tradable currencies, the Euro (EUR) is the second most traded currency in the world, behind the US Dollar. This currency pair is the most traded and liquid currency pair in the market. As the most popular trading pair, EUR/USD is a staple of all brokerage offerings and often has some of the lowest spreads compared to other pairs. Ultimately, the currency trails the two most economical blocs in the world and sees the most volume for this reason. EUR/USD has a wide range of factors that influence its rates. On the Euro side, Eurozone economic data as well as internal bloc factors can easily impact rates. Even smaller member states can effectively weigh on the euro, as seen in Greece during bailout talks in the 2010s. Alternatively, developments in the United States and at the Federal Reserve generally affect the EUR/ usd. Many examples include bailouts during the financial crisis, tax cuts under the Trump administration, and Covid-19 relief measures, among others.

The EUR/USD is the currency pair comprising the single currency of the European Union, the euro (symbol €, code EUR), and the dollar of the United States (symbol $, code USD). The pair rate indicates how many euros are needed to buy a dollar. For example, when EUR/USD is trading at 1.2, it means that 1 euro equals 1.2 dollars. Why EUR/USD is the most popular trading pairCompared to all tradable currencies, the Euro (EUR) is the second most traded currency in the world, behind the US Dollar. This currency pair is the most traded and liquid currency pair in the market. As the most popular trading pair, EUR/USD is a staple of all brokerage offerings and often has some of the lowest spreads compared to other pairs. Ultimately, the currency trails the two most economical blocs in the world and sees the most volume for this reason. EUR/USD has a wide range of factors that influence its rates. On the Euro side, Eurozone economic data as well as internal bloc factors can easily impact rates. Even smaller member states can effectively weigh on the euro, as seen in Greece during bailout talks in the 2010s. Alternatively, developments in the United States and at the Federal Reserve generally affect the EUR/ usd. Many examples include bailouts during the financial crisis, tax cuts under the Trump administration, and Covid-19 relief measures, among others.

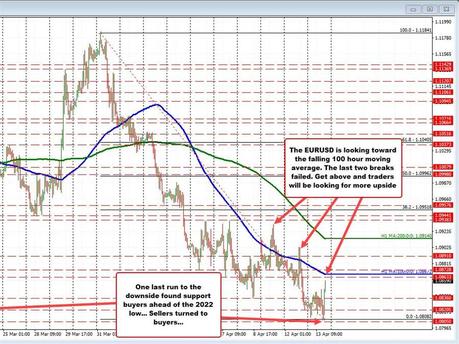

made a final downward descent in the New York session, reaching a new low for the day at 1.08082 just above the March 7 low of 1.0805. The inability to break below this low turned sellers into buyers, and the price rose over the past hour or two to new session highs (see previous post).

The day's range for the EURUSD has been extended with the current price trading at 1.0855. However, the 48 pips is still well below the 22-day average of 83 pips. There is room to roam.

The next upside target comes against its falling 100 hourly moving average (blue line) at 1.08672.

Recall from yesterday - and also from Monday - EURUSD price broke above this moving average level and then stalled and retraced lower.

Therefore, reaching and staying above the 100 hourly moving average would be a key barometer and show buyers' willingness to push this pair higher after the trend decline that saw the pair drop from 1.1184 on the 31st. March low today at 1.0808 (376 pips down in 10 days). Without that, and the correction is still only modest attempts to bottom the pair.

A new high today is acceptable after the failure of the new low, but there is still a lot of work for buyers to do if they want to gain more control.

Falling rates and rising US equities helped the EURUSD, leading to outflows from the USD.

The US 2-year is down -9.0 basis points. the

The Nasdaq Stock Market or NASDAQ is an American stock exchange. It only tracks the New York Stock Exchange (NYSE) in terms of market capitalization and is part of a network of stock markets and options exchanges. Launched in 1971, NASDAQ is the acronym for the National Association of Securities Dealers Automated Quotations. Since then it has been known simply as NASDAQ and has become one of the most influential stock exchanges in the world. OTC) trading system. What makes up the NASDAQ? In particular, the exchange also includes the NASDAQ Composite, which includes almost all stocks listed on the NASDAQ stock market. Along with the Dow Jones Industrial Average (DIJA) and the S&P 500 Index, it is one of the three most followed stock market indices in the United States. Overall, the NASDAQ stock market has three different market levels. This includes the capital market, or a stock market for companies with a relatively small market capitalization. Listing requirements for small cap companies are less stringent than for other Nasdaq markets which list larger companies with significantly higher market capitalization. Additionally, the global market is made up of stocks that represent the global Nasdaq market. The Global Market consists of 1,450 stocks that meet stock exchange financial and liquidity requirements and corporate governance standards. Finally, the Global Select Market is a market capitalization-weighted index comprised of 1,200 US and international stocks that represent the Global Select Market Composite.

The Nasdaq Stock Market or NASDAQ is an American stock exchange. It only tracks the New York Stock Exchange (NYSE) in terms of market capitalization and is part of a network of stock markets and options exchanges. Launched in 1971, NASDAQ is the acronym for the National Association of Securities Dealers Automated Quotations. Since then it has been known simply as NASDAQ and has become one of the most influential stock exchanges in the world. OTC) trading system. What makes up the NASDAQ? In particular, the exchange also includes the NASDAQ Composite, which includes almost all stocks listed on the NASDAQ stock market. Along with the Dow Jones Industrial Average (DIJA) and the S&P 500 Index, it is one of the three most followed stock market indices in the United States. Overall, the NASDAQ stock market has three different market levels. This includes the capital market, or a stock market for companies with a relatively small market capitalization. Listing requirements for small cap companies are less stringent than for other Nasdaq markets which list larger companies with significantly higher market capitalization. Additionally, the global market is made up of stocks that represent the global Nasdaq market. The Global Market consists of 1,450 stocks that meet stock exchange financial and liquidity requirements and corporate governance standards. Finally, the Global Select Market is a market capitalization-weighted index comprised of 1,200 US and international stocks that represent the Global Select Market Composite.

the index is up 213 points or 1.6%.

ADVERTISEMENT - KEEP READING BELOW