SeanPavonePhoto/iStock via Getty Images

Magnachip Semiconductor Corporation (NYSE:MX) is up double digits in premarket trading as there is an article in the Korean press suggesting that South Korean LX Group is looking to buy the company for about a billion Korean won ($790 million). The market seems to believe that the assumed number is way too low, as its price has risen above the number implied in the article.

According to the article, LX Group will submit a Letter of Intent (LOI) as early as next week, based on more than one investment banking source. It's supposed to be a strategic investment. LX Group is also a technology company and seeks synergies between MX and its semiconductor branch. Usually, strategic buyers can pay a little more (or will pay a little more) than financial buyers.

About the price, the article states the following (using Google Translate):

The company's shares are traded on the New York Stock Exchange. Its market capitalization stood at 843.3 billion won on Tuesday. Magnachip's entire stake, including the management fee premium, could reach 1 trillion won, the sources said.

and with an interesting afterthought:

Since then, Magnachip has been looking for other buyers, mainly Koreans.

I have written several articles on the Magnachip saga (such as Magnachip & Wise Road Capital: Market Considers This Deal Dead). In the last, I summarized buyer interest as follows (regarding the bidding process leading to the sale of Wise Road, which subsequently failed):

Among the bidders were at least two parties from the United States. My understanding is that the US sides mostly gave in because of the severance pay claims. Wise Road is now on the hook for ~$70 million and has waited several months without showing anything for it. Magnachip is operating as usual and has an additional $170 million. It was a generous severance package to compete against.

At the time, there were at least two strategic bidders (instead of financiers like Wise Road). In general, strategic bidders should be able to bid higher because of synergies and things like that. Wise Road ultimately won the "price" with a bid of $29 per share, but the undisclosed A party bid as high as $25, C party went up to $28, and G party was ready to go up to 29 $ (but did not match the break-in fee).

Note that a Chinese private equity firm ended up being willing to shell out $29/share and topped that off with huge breakout fees (which then ended up making MX rich). Break fees tend to deter others from taking over. Of course if they are very big, as was the case here.

Unsurprisingly, no one topped the $29 offer, but there were at least two matches that matched Wise Road's offer.

The number of 1 trillion Korean won suggests a price of $16.63 per share. I think that's a bit too low. I wouldn't be too thrilled if the board sold it there. I can't imagine Oaktree (of Howard Marks fame and holding a 5% stake) would be happy with this resignation.

Imagine what the board looks like if they accept an offer from a Chinese company (which is kind of a risk factor, although I'm still surprised that it materializes) and that offer fails for national security reasons. Meanwhile, there were dozens of other bidders, and some also bid $28 or $29. Two of the offers are known to have come from companies based in the United States. What does it look like if you fail to accept a lower bid of a dollar (to be fair, I can't be sure these were also bidders with associated risk), then let the deal be closed... Then move on and sell it for $13 less!

It won't look smart, and I can't imagine them taking something like that.

Not at all because the company is doing well. He's profitable, debt-free, has a huge cash balance, bought back a bunch of stock, analysts think he's growing, and he's getting a nice payout from Wise Road for his troubles. Of course, today's semiconductors generally go for a lower multiple than they were aiming for back then, but MX isn't exactly a run-off-the-mill situation.

After the last buyback (using the diluted share count), I believe there are approximately 47.5 million shares outstanding. Magnachip has $5.90 per share in cash and no debt.

In effect, the acquirer would pay $13.73 per share. It could also easily increase trading a bit and recoup a few extra dollars per share without losing much profitability or increasing risk too much.

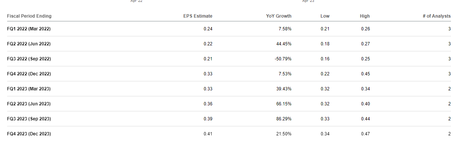

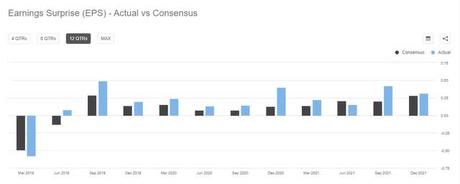

Analyst estimates for the near future look like this:

That's $1.50 per share for the year 2023. The company also tends to surprise on the upside of estimates:

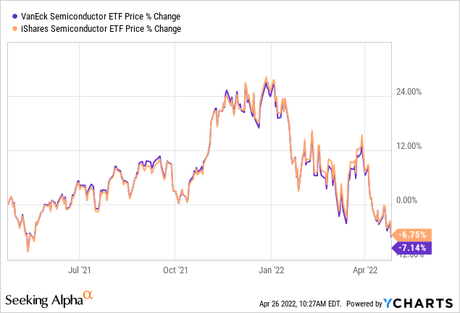

In my experience, offers are less likely to suffice if the stock has traded higher over the past 12 months. Magnachip has traded above $24 for the past twelve months:

Data by YCharts

Data by YCharts

I can easily believe there is interest in Magnachip Semiconductor. The semiconductor space has been down a lot in recent months, but if we look back a year, the sector is only down single digits. A major surge occurred after the Wise Road deal:

Data by YCharts

Data by YCharts

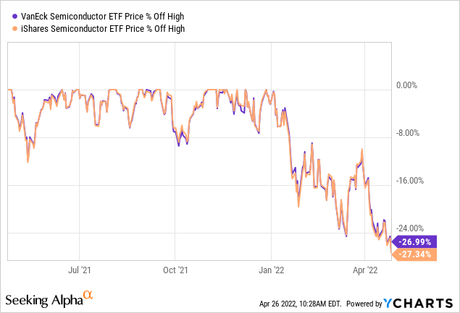

Since the peak, the industry is down about 27%:

Data by YCharts

Data by YCharts

If you simply apply the 27% correction to the $29 offer, that implies an offer of $21.17 per share.

In summary, I can imagine that we will see a letter of intent next week. I find it hard to envision a deal below $20. The only way I can imagine a price of around $16 per share is if the company first pays out a big ~$5 special dividend to empty its coffers. Most of the other options make the table look misguided.

As a shareholder, I would much rather see the company continue to operate independently than a sub-$20 offer. Just increase the debt. Use that and the cash balance to pay out a special dividend of $8. Then keep increasing earnings to $1.50 per share and I'll be more than happy to continue as a long-term shareholder.