As the name suggests, medicare supplement plans are insurance policies which add value to original medicare plans. Original medicare plans exist in two distinct parts; Part A and Part B. These mainly cover for your healthcare services but not all expenses. For example, coinsurance, copayments and yearly deductibles are not covered by original medicare plans. Therefore, medicare supplement plans step in to bear those expenses.

How supplement plans work.

You must also be 65 years and above to qualify for medigap plans in 2019. This is applied in all states, and no insurance company is obliged to give you a medigap policy if you don't meet these requirements. To put things into perspective, let's consider a sample situation. Supposing you have an outstanding bill for laboratory tests and x-rays and you have paid the annual Part B deductible. The medicare part B pays up to 80% of the bill. However, if you have a medigap policy which pays covers for part B copayments and coinsurance costs, then, it is the duty of Medicare part B policy to pay for the remaining 20% of the bill. Simple, isn't it? Let's look at some of the benefits covered by medigaps.

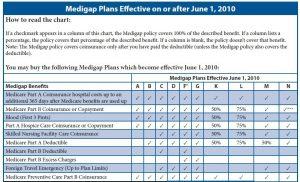

Medigap plans K and L have a certain usage limit such that when this limit is reached, they cover the costs for the rest of the year.

All medigap policies cover: -Medicare Part A hospice coinsurance, Medicare part B coinsurance and the first three pints of blood received by hospitals.

Plans C and D cover for skilled nursing facility care coinsurance and Medicare Part A deductibles. On the other hand, medigap plans A and B do not cover skilled nursing facility care coinsurance.

Foreign travel exchange is partly covered by medigap plans C and D. This is up to 80%.

Generally, original medicare plans are not enough to cover all your health insurance needs. Therefore, you should get medigaps to boost your health insurance.