Neither the author, Tim Fries, nor this website, The Tokenist, provides financial advice. Please review our website policy before making any financial decisions.

The non-fungible token (NFT) market reached new heights in 2021 and multi-million dollar sales made headlines. Even though the broader cryptocurrency market had a rocky start to the year, OpenSea recorded the highest monthly trading volume ($3.5B+) in January 2022 and around 44.2B dollars were poured into the growing market last year.

With so much value in the mix changing hands so quickly, some wonder if it's more tax evasion or money laundering, rather than true art.

Last week, IRS CI (Criminal Investigation) Agent Kroner said so, noting that NFTs are ripe for fraud. However, this is nothing new to the art world, except that the medium of exchange has evolved.

NFT - Same scam, different medium?

Physical art galleries have been known for decades as ideal vehicles for money laundering. Art inherently has a subjective value, so a price tag can be agreed between interested parties. Such a process can be summarized in a few steps:

- Buyer A has $1 million, ready to buy a remarkable work of art.

- The artwork is transferred to freeport for storage, which is a designated and lightly taxed area to encourage economic activity.

- Buyer A then sells the artwork to buyer B at the same location, with $1 million legitimized.

In the pre-2020 period before the shutdowns, the IMF reported that illegal art trafficking was worth $6 billion a year, half of which can be attributed to money laundering. It is then easy to imagine how blockchain-encrypted digital NFTs would pose a considerably greater challenge to authorities.

Courtesy of Chainalysis, we can quantify this image.

$44.2 billion paid into NFT smart contracts in 2021

As you know, tokens are smart contracts that serve many purposes. Regular fungible tokens serve as economic units, grant voting and governance rights, in accordance with the ERC-20 smart contract standard. NFTs, being non-fungible, follow the ERC-721 and ERC-1155 standards instead.

The latter is a newer hybrid smart contract, allowing for multiple fungible and non-fungible tokens, and can be processed in batches. Considering both types, ERC-721 and ERC-1155, the NFT market saw an influx of $44.2 billion in crypto assets in 2021. This is a massive 416x increase from 2020.

Attracting NFT Investors with Wash Trading

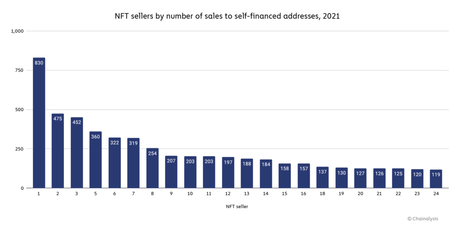

If you have ever wondered how it is possible that so many NFT traders have emerged in such a short time, then wash trading should suffice as an explanation. This is an age-old manipulation of the market in which the buyer is also the seller. Buying and selling the same asset creates a false impression of market activity.

This is especially important for NFTs, as most buyers would eventually want to profit from a resale. However, as NFTs are speculative and illiquid assets, this potential resale is entirely dependent on demand, i.e. market liquidity. For this reason, wash trading is rampant in NFT markets.

Source - Chainalysis

Source - Chainalysis

By analyzing self-funded NFT addresses, Chainalysis generated $8.87 million in profit from the wash trade. However, not all wash trading sticks. Of a total of 262 NFT addresses analyzed, 152 were unprofitable, resulting in a loss of $416,900. Interestingly, although illegal in the stock market, wash trading has not yet been legally prohibited for blockchain assets.

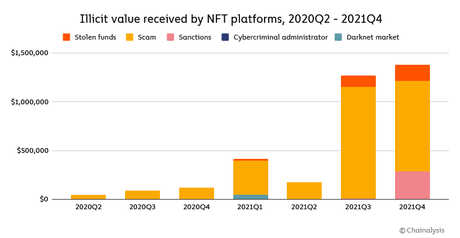

NFT in money laundering

Money laundering legalizes illicitly obtained funds. Therefore, the IRS or other law enforcement agencies ask no questions. Digital assets are perfectly aligned to develop this underground industry. However, with the exception of privacy coins such as Monero (XMR), blockchain also enables transparency.

In fact, it makes illicit flows on blockchains more quantifiable than on seedy freeports. Chainalysis used its tracking tools to derive the following breakdown of this activity.

Source - Chainalysis

Source - Chainalysis

Compared to wash trading, NFT marketplaces have seen minor traffic from criminal activity. To be reborn as an NFT, only $1.4 million can be attributed to money laundering. Scams make up the bulk of criminal activity, increasing sharply from Q2 to Q3 2021. In contrast, Q4 2021 saw a drastic increase in traffic from a sanctioned platform, to $284,000.

The prohibited platform, considered as such by the Department of Justice (DOJ) and the Office of Foreign Asset Control (OFAC) of the United States Treasury, is Chatex. It is a peer-to-peer (P2P) crypto exchange service similar to LocalBitcoins. However, it works like an automated Telegram bot, bypassing all KYC/AML protocols.

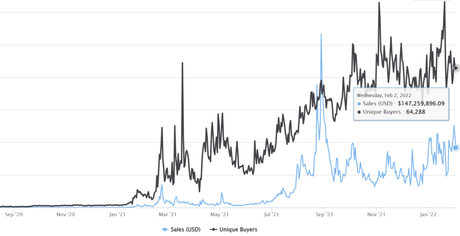

NFTs Continue to Ignore Crypto Headwinds

With the crypto market downturn in January, driven by Bitcoin falling more than 20%, NFTs are going through the so-called crypto winter. According to Block research, January generated $6.86 billion in NFT transaction volume, a 3x increase from December's $2.67 billion.

Source - CryptoSlam NFT Global Sales Volume Index

Source - CryptoSlam NFT Global Sales Volume Index

Surprisingly, most of this volume came not from OpenSea, the dominant NFT marketplace, but from LooksRare. After its launch on January 10, the new NFT marketplace has accumulated nearly $2 billion in trading volume. Just like Rarible has its RARI token, LooksRare has its own LOOKS token used for governance, allowing people to earn rewards every time they trade.

However, LooksRare is also full of washout transactions, according to CryptoSlam, the NFT analytics platform.

Fix... Make that over $8 billion in wash sales. I forgot to include Terraforms in the first tweet:

Meebits: $4.4 billion

Terraforms: $2.9 billion

Loot: $705 million

Cryptophunks v2: $251 million

Other: $62 million- CryptoSlam! (@cryptoslamio) January 28, 2022

Despite this massive reduction in fake traffic, NFTs continue to diverge from the crypto market as their own niche asset class. Moreover, it appears that NFTs are much more difficult to use for malfeasance than one would think at first glance.

From wash trading to money laundering, blockchain transparency is likely to make criminals and scammers think twice before pinning their hopes on the emerging market.

Finances change.Try it for free)

Did you know that you can trace every NFT smart contract on EtherScan, ensuring your potential purchase is from the original NFT publishers?About the Author

Tim Fries is the co-founder of The Tokenist. He has a B.Sc. in Mechanical Engineering from the University of Michigan and an MBA from the University of Chicago Booth School of Business. Tim was a senior partner on the investment team in the US Private Equity division of RW Baird and is also a co-founder of Protective Technologies Capital, an investment firm specializing in detection, protection and control solutions.