Nickel prices hit their highest level in more than six months, underscoring the deterioration in trading conditions since the market chaos erupted in March.

The benchmark nickel contract for three-month delivery briefly hit the London Metal Exchange's 15% daily trading limit, hitting nearly $31,000 a tonne on Monday. That was followed by a 5% rise on Tuesday after a nickel mine in New Caledonia, which supplies Tesla, cut its fourth-quarter production forecast.

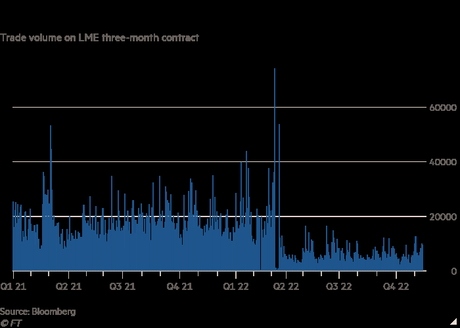

Trade sources said the volatile price movements are a testament to the poor liquidity that has plagued the market since the LME suspended and canceled billions of dollars in nickel trades in March following an unprecedented price rise. .

"The market is still very thin. What we've seen are the effects of low liquidity unfolding before our eyes," said Geordie Wilkes, head of research at Sucden Financial, a metals brokerage firm.

Nickel, used to make stainless steel and the batteries used in electric cars, had an extremely turbulent year. Sanctions fears against Norilsk Nickel, a major Russian producer, coincided with a huge bet by the world's largest stainless steel producer, Tsingshan, that prices would plummet, causing prices to more than double in a matter of days in March.

Nickel prices rose nearly 25% in five days on optimism over the reopening of the Chinese economy and Beijing's support for the real estate sector, as well as a weaker US dollar following data inflation better than expected.

But Nikhil Shah, head of nickel research at consultancy CRU, said the string of positive news 'does not justify the rally we've seen' and 'we could see a strong correction over the next few months'. .

Volume in the LME's three-month nickel contract since March has been 30% of levels in the six months before the market chaos, according to Bloomberg data.

Prony Resources, the owner of the Goro nickel mine in New Caledonia, which is part-owned by commodity trading giant Trafigura, said in a statement that production had to be cut in the last three months of the mine. year because heavy rains caused a "limited release". of salt-laden liquid" from its tailings dam.

Videos of an explosion at a nickel smelting plant in Indonesia were circulating on social media on Monday, but the site's Chinese owner said production had been operating normally from the start to the end of last month.

Recommended

A nickel trader said the main driver of the nickel surge was a weaker dollar exacerbated by low liquidity in the nickel contract. "Any supply problems are not significant."

Nickel producers are increasingly concerned about the adverse impact of volatility. Jeremy Martin, managing director of Horizonte Minerals, a London-listed developer of nickel projects in Brazil, said a stable price of $20,000 to $25,000 would be best.

"What is very difficult are these very large peaks. Everyone then says 'we have to have an alternative, we have to replace and nickel is not that stable entry product that we thought it was for our battery technology,'" he said.