simarts/iStock Editorial via Getty Images

A lot has happened since my last post on April 20. The bank published excellent results, which caused the stock to rebound somewhat. However, subsequently, the financial markets were quite stressed due to the Fed's hawkish rhetoric and the ECB's decision to raise interest rates. This caused the financial markets to explode. Although higher interest rates generally mean higher profits for the financial sector, banking stocks are more sensitive than the broader market. In other words, banks are very cyclical and do not do well during recessions. At the same time, UBS ( NYSE: UBS ) is an undervalued profitable bank and its stock should eventually recover. Let me explain this in more detail.

The bank's financial results

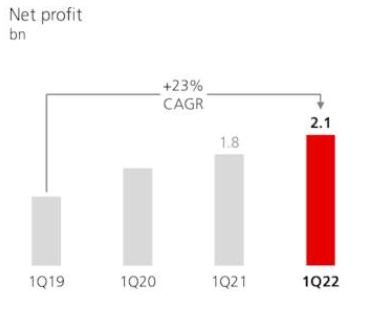

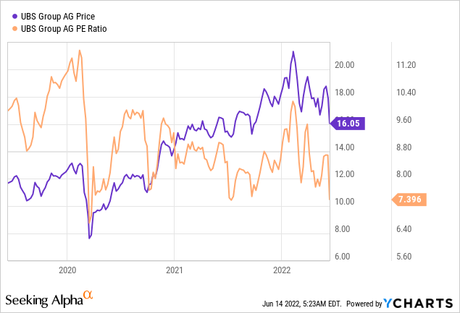

Between 2012 and 2018, the bank's quarterly results did not show stable growth. However, between 2018 and 2022, the bank posted solid growth in earnings per share (EPS), but the share price did not follow. As the chart below shows, the start of 2020 was the perfect time to buy stocks.

The same goes for the latest financial results, published at the end of April.

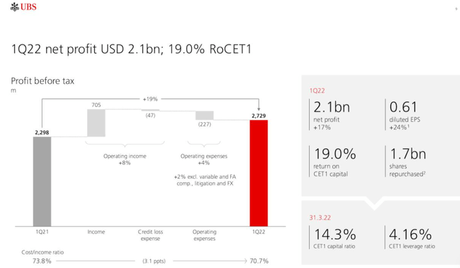

Many financial indicators reported for the first quarter of 2022 were really good. For example, the CET 1 capital ratio for 1Q2022 was 14.3%, while the requirement is 10%. The return on CET1 capital was 19%, which is quite solid considering the bank's high CET1.

But the biggest development for 1Q2022 was the net profit figure of $2.1 billion. By itself, that may not mean as much, but if we look at the net profit history for the last four years, we will see that there has been substantial growth. Net income increased from $1.8 billion in 1Q2021 to $2.1 billion in 2Q2022, an increase of almost 17%. This is quite impressive, given the bank's conservative profile.

Suppose the bank reports exactly the same profit for each of the following three quarters. So $2.1 billion multiplied by 4 gives us $8.4 billion. The current market capitalization is around $60 billion. If we divide the current market capitalization by $8.4 billion, we will get a price/earnings ratio (P/E) of 7.14, which is not high at all.

In fact, if we look at the chart above, the bank's P/E ratio is now near 3-year lows. The current indicator is only slightly above the spring 2020 low of around 6.5. The latter made sense at the time since the global pandemic has crippled the economies of many countries. So the stock markets crashed. At present, there is also a reason for the decline in stock prices, namely the monetary policy of central banks.

The monetary policies of central banks

The Fed, the ECB and even the Swiss National Bank are sounding the alarm - inflation indicators are near multi-year highs. The ECB and the Fed have already started raising interest rates. The Swiss National Bank has also decided to raise interest rates. This has not happened for years since in Switzerland the inflation rate is traditionally very low or even negative.

Monetary tightening is generally bearish for the global economy since it usually causes recessions. The banking sector is also very cyclical and is affected by macroeconomic conditions. However, we can also say with certainty that, provided there is no recession, rising interest rates should increase the interest income of the financial sector - the profits from borrowing and lending. So it really depends on the direction the economy takes. Nevertheless, UBS is not a very standard bank, in this sense.

UBS as a bank

As a bank, UBS would not lose much even in a severe recession. Here, I am not even referring to the fact that the Swiss government came to the rescue of UBS during the crisis of 2008-2009, which also affected Switzerland. After the crisis, UBS changed its risk profile and became more conservative than before. This makes sense since UBS is a bank for the rich. In other words, he doesn't rely too much on lending money to highly indebted individuals and businesses.

This is a great advantage for UBS - in other words, it would not suffer from client bankruptcies as much as its peers, since it has no risky clients.

While I'm not sure exactly when this correction will end and if there will be a recession soon, in my opinion buying UBS at a discount would make perfect sense since it is "recession resistant".

Technical analysis

Of course, technical analysis is only secondary to fundamental analysis. However, I decided to perform an analysis using Bollinger Bands.

In other words, the stock price of the bank moves within certain bands or lines. It is in a certain trend. Right now, the 5-year trend seems to be up. There is some volatility and information noise along the way, but overall the trend remains intact.

On the graph above since 2020, there is an upward movement in the bank's share price. Provided there was no recession in the next few months or any other significant financial distress, UBS stock price would continue to rise and investors would do well if they bought when the going was tough. "blood in the streets".

In my opinion, it is not a good idea to invest when the stock market indices are at their all-time highs and the financial media advocates active investing. Exactly the opposite is true - it's better to buy stocks of healthy companies after they correct when everything else is crashing. UBS hasn't faced any major scandals in the past few years, posted excellent profits, but its stock has corrected somewhat during the market sell-off.

Conclusion

UBS is a highly profitable bank for the wealthy operating in a cyclical industry. Its stock has become cheaper mainly due to information noise. Provided there is no recession in the next few months, the stock has great upside potential in the near future. Technical analysis suggests a strong uptrend. It is better to invest in profitable banks when everything is selling at a discount.